Protecting

California's

Coverage Process

California has prioritized expanding access to affordable, high-quality health care—and it’s paying off.

94% of Californians have health care coverage, including over 14 million Californians who are enrolled through Medi-Cal Managed Care plans. That means families can get the care they need without the fear of overwhelming medical bills. It also ensures that hospitals are reimbursed when patients seek emergency care, which keeps costs lower for consumers.

This is progress worth protecting.

94% of Californians have health care coverage, including over 14 million Californians who are enrolled through Medi-Cal Managed Care plans. That means families can get the care they need without the fear of overwhelming medical bills. It also ensures that hospitals are reimbursed when patients seek emergency care, which keeps costs lower for consumers.

This is progress worth protecting.

Health Care Coverage Growth Timeline

What’s at Stake

Medi-Cal Managed Care keeps hospitals and clinics open, supports more than 7% of California’s workforce, and strengthens local economies. But now, funding cuts from the Federal and State governments could mean fewer services, less access, and instability. We must protect Medi-Cal, preserve our progress, and ensure that enrollees can continue relying on their managed care plans to deliver the high-quality, community-based care Californians deserve.

To keep members covered, Medi-Cal Managed Care Plans are taking action.

Educating themselves, providers, and members on program changes.

Communicating options like telehealth to ease access and encourage care visits.

Partnering with counties to coordinate and align on upcoming changes.

Medi-Cal health plans are committed to working in partnership with California leaders to protect Medi-Cal access and preserve gains in health care coverage.

The Impact of New Federal Policies on Medi-Cal Eligibility

New federal policies recently passed by Congress and signed into law by the President (H.R. 1) will significantly impact Medi-Cal and Medi-Cal Managed Care plans. H.R. 1 could jeopardize Medi-Cal and Medi-Cal Managed Care plans by restricting how California can fund its program, particularly through provider taxes that help secure federal matching dollars. This change could create major funding shortfalls, threatening access to care for millions of Californians and undermining the stability of the state’s health care system.

State Financing Restrictions

- Managed Care Organization (MCO) tax and Provider Tax limitations.

- To address a $12 billion budget shortfall, California has frozen Medi-Cal enrollment for undocumented immigrants aged 19 and over.

- Federal funding repayment penalties for eligibility-related improper payments

Immigrant Coverage Limitations

- Reduction in Federal matching assistance percentage for emergency unsatisfactory immigration status (UIS)

- Restrictions on lawful immigrant eligibility (increases UIS)

Eligibility/Access Requirements

- Work requirements

- Increased frequency of eligibility checks to every 6 months

- Retroactive coverage restrictions

- New cost-sharing requirements for certain members.

Abortion Providers Ban

- One-year ban on federal Medicaid funding for “prohibited entities” that provide abortion services

By changing eligibility requirements, H.R. 1 will significantly reduce the number of Californians who are eligible for Medi-Cal – meaning millions of vulnerable Californians are at-risk of losing access to care.

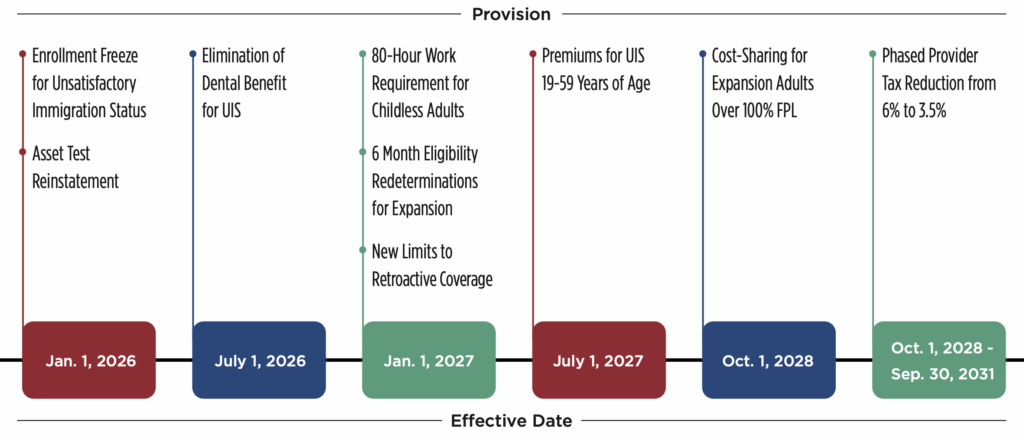

What Medi-Cal Members Need to Know – Policy Changes 2026-2028

More information is available at DHCS Medi-Cal Changes.

Older Adults and People with Disabilities

Asset Limits

Starting January 1, 2026, when members apply for or renew their Medi-Cal, the state will look at what they own. This is called an asset check. Assets are things members own that have value. The most members can own (asset limit) is $130,000 for one person. Assets include bank accounts, cash, and more than one house or vehicle.

Adult Immigrants

Enrollment Freeze

Starting January 1, 2026, some adults will no longer be able to sign up for full-scope Medi-Cal coverage based on their immigration status. Medi-Cal members may be affected if they are undocumented (live in the U.S. without legal permission), or are a lawfully present immigrant who is 21 or older and not pregnant.

Dental Coverage

Starting July 1, 2026, some Medi-Cal members will stop getting full-scope dental services as part of their coverage due to changes in state law.

Monthly Premiums

Starting July 1, 2027, some Medi-Cal members will need to pay a small monthly fee (called a premium) to keep their full-scope Medi-Cal.

Adults (19-64 years old)

Work Rules

Starting January 1, 2027, some adults will need to work or volunteer to get or keep Medi-Cal. If this applies, the county Medi-Cal office will send members a letter.

Six-Month Eligibility Checks

Starting January 1, 2027, some Medi-Cal members will have their eligibility checked twice a year instead of once.

Less Time to Get Help Paying Old Medical Bills

Starting January 1, 2027, Medi-Cal will pay for fewer months of medical bills from before members applied.

Copayments

Starting October 1, 2028, some adults on Medi-Cal may have to pay a small fee (called a copayment) for certain health care services.

Most Medi-Cal members won’t see any changes

Members can still:

- See their doctor or go to the hospital.

- Get emergency help.

- Get medicine.

- Get support for mental health or addiction.

- Have checkups and vaccines to stay healthy.

- Get long-term care if needed.

- Get rides to appointments if needed.

- See a dentist.

- Get eye exams and glasses.

How to Maintain Medi-Cal Coverage

To ensure Medi-Cal coverage is maintained, enrollees should:

- Keep contact information up to date so important notices are received.

- Check mail regularly and respond promptly to any letters or renewal forms.

- Know renewal dates and complete renewals on time, even if reminders are not received.

- Continue attending doctor and medical appointments to ensure ongoing care.

- Access resources at dhcs.ca.gov for additional guidance and support.